To conserve money on vehicle insurance policy, numerous family members take into consideration enlisting teens in safe driving programs or motorists ed programs. These programs are constructed to notify vehicle drivers when they are succeeding, as well as where to make changes to boost security. Many insurer use price cuts to teenagers who finish these programs successfully as well as show signs of safe, accountable driving (vehicle insurance).

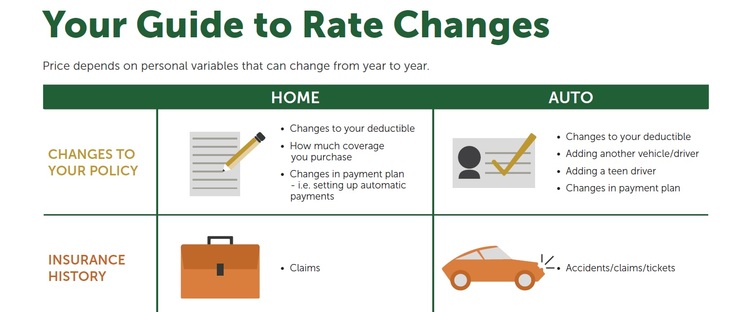

Use our tool listed below or call us at What Else Affects Your Automobile Insurance Coverage Rate? In addition to age and also driving history, right here are some various other things that can impact average car insurance policy rates: Sex Location Marital standing Credit report score Type of cars and truck you're insuring Safety functions on your car While lots of variables like age and gender are out of your control, there are still several points that might certify you for lower prices.

That's because they are reasonably inexpensive to fix as well as much safer on the road. On the various other hand, foreign and also luxury vehicles are thought about a high-risk for vehicle insurance provider since parts are pricey. These cars are also much more susceptible to burglary and careless driving. Several drivers see declines in automobile insurance policy prices after they gain much more driving experience, prevent obtaining tickets, and prevent accidents - car insurance.

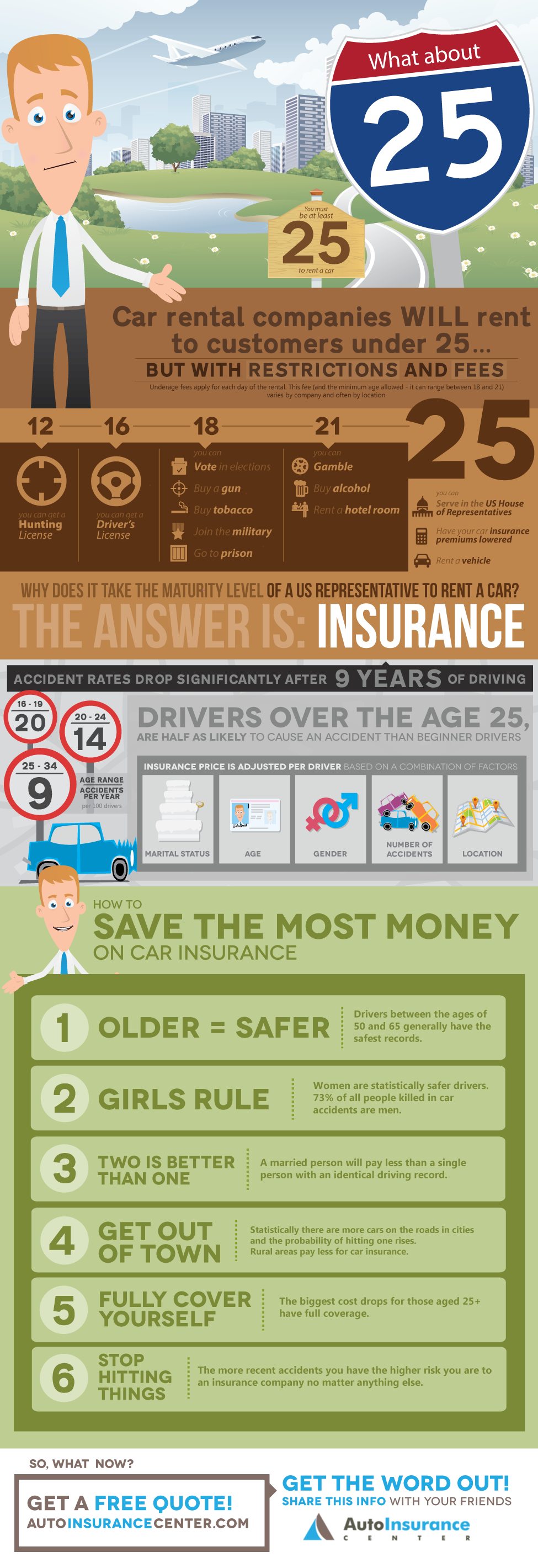

All of it depends upon the quantity of driving experience you have as well as for how long you maintain a risk-free driving document. For instance, if you obtain your certificate right when you turn 16 and also maintain a clean driving document for a couple of years, you must start to see lower rates once you reach your mid-20s.

automobile insure automobile credit

automobile insure automobile credit

This two-year driving history might not be long enough to confirm to insurance provider that you have reduced your danger. To preserve a tidy driving document, maintain these secure driving suggestions in mind: Restriction the variety of other teen passengers and distractions. Never drive with your phone in your hand or while consuming.

Excitement About What Can Raise Or Lower The Cost Of Your Car Insurance- Aaa

Our Referrals For Car Insurance Policy No matter of your age, you must shop around to find the best auto insurance rates. Each firm supplies its very own benefits and value, so it's up to you to determine what you require from your insurance policy carrier.

For many folks, insurance is seen as an intricate matter, particularly when it concerns car insurance coverage for young people given that they often tend to pay the greatest costs of all vehicle drivers. One of the most vital concerns young people have on their minds concerning cars and truck insurance policy is, "Does car insurance coverage go down at 25?"Well, the brief response to this question is indeed - low cost auto.

Just how a lot does car insurance policy go down after turning 25? Each year of driving experience equates to reduce automobile insurance policy rates (trucks). The suggestion behind this strategy by insurance policy companies is that once vehicle drivers transform 25, they have enough experience behind the wheel to make them less of an obligation; hence they are entitled to pay relatively reduced costs.

automobile accident credit score auto insurance

automobile accident credit score auto insurance

If you are a 24-year-old, vehicle insurance policy will certainly cost you typically 11% greater than when you reach 25. perks. You must also recognize that if you simply prevent any unfavorable cases while when driving and obtain zero website traffic infractions till you are 25, you will remain in a better placement when it comes to the vehicle insurance policy prices when you do transform 25.

When Does Auto Insurance Coverage Go Down? Enlightening oneself on the finer factors of automobile insurance policy and also the difference that age makes in the amount one has to pay will ensure that you will certainly take complete advantage of the expense cuts in automobile insurance coverage when the time is.

Getting My How Does Your Gender Factor Into Your Car Insurance? - The ... To Work

This is primarily because more youthful motorists are statistically extra prone to getting into an accident while on the road. As a result of a high number of cases, they cost the insurance policy companies much more cash in residential property damage as well as clinical costs. With time, young chauffeurs have a tendency to acquire even more experience behind the wheel, which results in the insurance premium gradually lowering.

Actually, some young motorists that have actually already transformed 25 will certainly not see any modifications in any way in regards to their insurance policy costs, despite the advantages that transforming 25 years old brings. It is due to the fact that they could fall under the complying with categories: Unskilled Drivers No matter just how old you are, your driving experience comes first.

prices risks cheapest auto insurance

prices risks cheapest auto insurance

25-year-old vehicle drivers who simply got their chauffeur's certificate a year ago are also mosting likely to be thought about unskilled by the insurance company. They will pay higher premiums than a 25-year-old that got an authorization at 15 as well as has actually been driving for a years - cheap car insurance. In both circumstances, the insurance provider is not mosting likely to take into consideration the age of the candidates however rather the years of driving experience they have.

This is great news for all female drivers out there looking for a cut in their automobile insurance premiums. The void is not that vast when it comes to what man as well as female vehicle drivers have to pay before they transform 25. For example, contrasted to the difference that 18-year-old males and also 18-year-old females pay (11%), or even the difference between what 23-year-old males and 23-year-old women pay (6.

Females normally pay less than males for cars and truck insurance coverage from age 16 to 26 since they're extra careful in driving and also much less prone to get in accidents (low cost auto). Keep in mind that in particular states throughout the United States, it is considered illegal for cars and truck insurance service providers to think about the sex of the driver while calculating the quantity of vehicle insurance policy costs.

The Ultimate Guide To When Does Car Insurance Go Down In Ontario - Ratelab.ca

Below's a checklist of the price cuts that are offered for 25-year-olds: A Telematics Program A telematics program has been created to compensate drivers that drive securely - auto insurance. Cars And Truck Safety Includes Does your auto have specific safety functions, such as anti-lock brakes or daytime running lights? You might get an auto insurance coverage price cut as a result of that.

The complying with are several of the variables detailed by the vehicle insurance service providers that might affect the quantity of costs that needs to be spent for vehicle insurance policy: This is another significant factor taken into consideration by the insurance policy suppliers. For those staying in California, Massachusetts, or Hawaii, a lower credit history may raise your vehicle insurance prices. laws.

Experience If you have actually simply started driving at 25 years old Click here for more info (or above) as well as it is additionally your very first time buying car insurance coverage, you're going to finish up paying even more than a motorist that got the certificate at 16. Postal code Your zip code is likewise going to make a difference in the quantity of cars and truck insurance policy premiums you have to pay (risks).

Finally, So, if you were wondering, "Does automobile insurance policy decrease at 25?" You should be pleased to recognize after reviewing this short article that your prices are likely to lower as soon as you transform 25 years old. That will certainly work provided you have a tidy driving record with no website traffic offenses or automobile accidents.

It is most likely that your cars and truck insurance coverage will increase after you have actually been in an accident. Nonetheless, it will mainly rely on your situation given that insurance policy providers consider each instance separately. What Is the very best Auto Insurance Provider? When it comes to cars and truck insurance carriers in the United States, the bright side is that there are a lot of options to select from.

More About Decrease Your Car Insurance Premium With One Simple Call

car car insured cheap cheap

car car insured cheap cheap

Does Automobile Insurance Coverage Go Down at 25 Allstate? Yes. Assuming that you have a good driving record, as soon as you transform 25 years of age, you can expect your premiums to drop. Then once more, it all depends on other elements that are taken into consideration by Allstate insurance (car). Does Your Cars And Truck Insurance Policy Go Down at 25 Geico? Yes.

Does Your Insurance coverage Go Down at 25 USAA? Yes. Insurance premiums tend to decrease once a person has actually reached the age of 25 just due to the fact that USAA does rule out 25-year-olds with an excellent driving record as high danger when it pertains to cars and truck insurance coverage. insurance companies. That claimed, having an excellent credit report along with residing in a low-risk location can also help drive down costs of cars and truck insurance.

As a guideline of thumb, it is recommended to seek advice from your insurance policy carrier before you join the bottom line to ensure that you are obtaining the most effective auto insurance policy prices around (car).

In this write-up: Generally, more youthful chauffeurs have a tendency to pay more for auto insurancebut when you get to the age of 25, the expense of your insurance coverage plan can drop. According to , the typical annual premium for a 24-year-old male with full protection is $2,273. At age 25, that balance drops to $1,989, a decrease of regarding 12.

auto insurance low cost auto cheap insured car

auto insurance low cost auto cheap insured car

If you prepare to wait till your policy restores, contact your insurer to ensure that you'll get a discount when it determines your price for the following plan duration. Ways to Lower Car Insurance Coverage Expenses, While you can't regulate all of the elements that go right into your auto insurance coverage rateyour day of birth is uncompromising, for instancethere are some that you can manage (cars).

Car Insurance Discount - New York Defensive Driving Things To Know Before You Buy

Bear in mind, each one will weigh various factors in different ways, and also some offer discount rates that others do not. Some cars and truck insurance policy companies use optional coverage that's good to have, yet might not be worth the price.

Most insurance providers provide discount rates to customers that buy multiple policies. You may be able to save money on your car insurance coverage by packing it with tenants insurance coverage, home owners insurance coverage, life insurance coverage, motorcycle insurance policy or other plan kinds. Some insurer provide a price cut if you participate in a protective driving program, either online or in-person.

You'll also obtain real-time notifies when changes are made to your credit rating report, such as brand-new accounts and also queries. Monitoring your credit score carefully will give you the info you need to construct and maintain a good credit rating.

From 30 to 64, cars and truck insurance premiums steadily decrease with the years, but, regrettably, you won't get those significant reductions as you saw at 25 - car insurance. When drivers strike 30, they've had great deals of experience on the road and also age ends up being much less of a variable in figuring out vehicle insurance policy premiums.

Young adults are usually an obligation behind the wheel. You could pay even more for insurance policy if you are a teen motorist or have a teenager running your car. How Can You Lower Your Automobile Insurance Rate? Below are some methods you can lower your automobile insurance coverage price: A mishap or traffic infraction will certainly create your rate to go up, so be a good driver behind the wheel.

Why Doesn't My Insurance Premium Go Down As My Car Gets ... Fundamentals Explained

The only time many of us think about our car insurance is when there is poor information, like a ticket or an accident. When you're young, single and incident-prone, rates just seem to go one way: up.